Mortgage Overpayment Calculator

Want to pay off your mortgage faster? Use our mortgage overpayment calculator to see how overpaying could reduce your interest and shorten your mortgage term.

Remaining Term

The number of years & months left on the term of your current mortgage.

Potential interest saving:

Potential term reduction:

Your new monthly payment:

Speak with one of our experts today to learn more about your options.

Get Started NowThis calculator provides an estimate of how much interest you could save and/or reduce your existing mortgage term by making overpayments based on the information you have entered. The figures are for illustrative purposes only; the actual amount by which your mortgage debt and/or term could be reduced may differ. Before proceeding with any overpayments, seek advice from a qualified Mortgage Broker.

Your home may be repossessed if you do not keep up repayments on your mortgage.

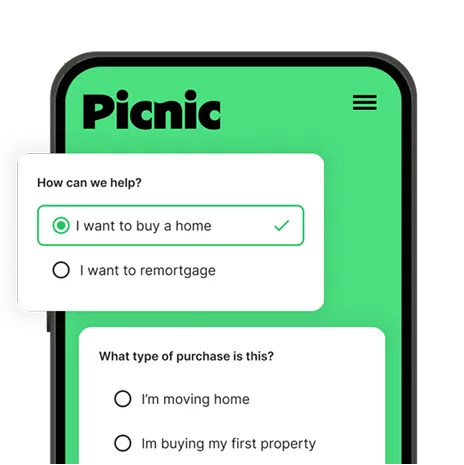

Tell Us About You

Fill out a quick 60-second form — no impact on your credit score, no endless questions.

Mortgage Match

We have access to 20,000+ products across more than 100 lenders (including exclusive deals you won’t find online) to find you the best rate and the right mortgage.

Meet Your Experts

A dedicated team handles everything. You can track your mortgage, conveyancing, and insurance progress directly from your portal.

The Mortgage Experts Trusted by Experian

Picnic is Experian’s exclusive mortgage partner, trusted to make mortgages simple. With access to 100+ lenders and expert support, we’ll help you find the right fit without the stress.

Mortgage Overpayments 101

Answers to all the key questions if you're considering overpaying on your mortgage.

Yes, it can be. But it really depends on your particular circumstances. Overpaying means you’ll repay your mortgage debt quicker and, over a longer period, you should save a lot on the interest payments.

The choice you need to make is whether overpaying on your mortgage will save more interest than you could earn from saving the amount you want to overpay. If the interest rate on your mortgage is higher than the savings rates available elsewhere, making overpayments would make more sense.

You can use our handy calculator (above) as a guide for what you could potentially save, based on your current mortgage balance and rate. It’s also important to check that the amount you want to overpay won’t incur any additional charges on your mortgage (see below).

Your lender will be able to confirm exactly how you’re allowed to overpay (and by how much without incurring fees). In most cases, you can overpay by increasing your monthly payments or a one-off lump sum (or a combination of the two).

Most people prefer to overpay on their monthly mortgage repayments, as it can be more straightforward and easier to budget for. With larger lump sums, it’s important to speak with your mortgage lender beforehand to make sure it is timed correctly (before an annual interest calculation is made) to ensure you save on the interest for that year.

Fixed-rate mortgages usually have an annual overpayment allowance (AOA), and in most cases, this is equivalent to 10% of your outstanding mortgage balance. So, you could overpay up to this amount without incurring any early repayment charges (ERCs) or additional fees.

For example, if your current mortgage balance is £150,000 and your AOA is 10%, you could overpay by up to £15,000 over the next year without incurring any additional charges.

Bear in mind that your AOA may vary from lender to lender. Therefore, it’s essential to review your specific mortgage agreement carefully before making any overpayments. The actual amount you can overpay will also alter each year as your mortgage balance reduces.

Most variable-rate mortgages allow you to make overpayments without any restrictions or incurring an early repayment charge (ERC). For example, a standard-variable rate (SVR) mortgage allows for unrestricted overpayments, so you can overpay by however much you want without paying any additional fees.

However, some lenders may impose an annual overpayment allowance on certain tracker mortgages. If you currently have this type of mortgage deal, you should check with your lender first before committing to any specific overpayment amounts.

Interest-only mortgages work differently from a traditional repayment mortgage, as you only repay the interest element to the lender each month and have a separate repayment vehicle to repay the capital amount as one lump sum at the end of the term.

So, if you overpay, whilst you could save money on the interest overall, you won’t be able to repay the mortgage in full until you have enough funds for the capital amount. In this instance, it may be worth considering how you could overpay on the capital repayment vehicle, as well as the interest, to fully repay your mortgage more quickly.